Mumbai: The Reserve Bank of India (RBI) has once again increased the policy rate repo by 0.25 percent in its bi-monthly monetary policy review today, mainly aimed at controlling inflation.

Due to this, the main policy rate has increased to 6.50 percent. At the same time, the central bank has raised the gross domestic product (GDP) growth forecast for the current financial year 2022-23 from 6.8 percent to 7 percent.

The gross domestic product (GDP) growth rate in the next financial year is estimated to be 6.4 percent. Repo rate is the interest rate at which commercial banks borrow from the central bank to meet their immediate needs.

An increase in this means that borrowing from banks and financial institutions will become costlier and the monthly installment (EMI) of existing loans will increase.

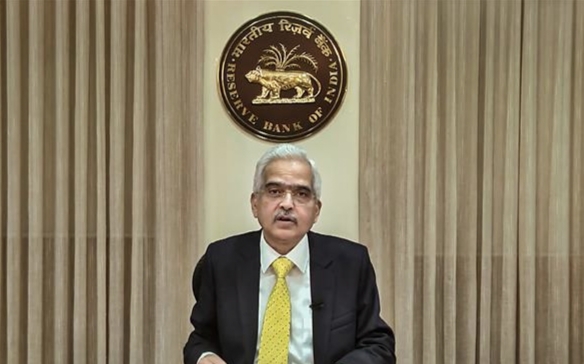

“In view of the current economic situation, it has been decided to increase the MPC policy rate repo rate by 0.25 per cent to 6.50 per cent,” RBI Governor Shaktikanta Das said in a digitally-circulated statement, giving details of the decision taken at the three-day meeting of the Monetary Policy Committee (MPC) that began on Monday.